Saving vs. Investing: What’s the Difference?

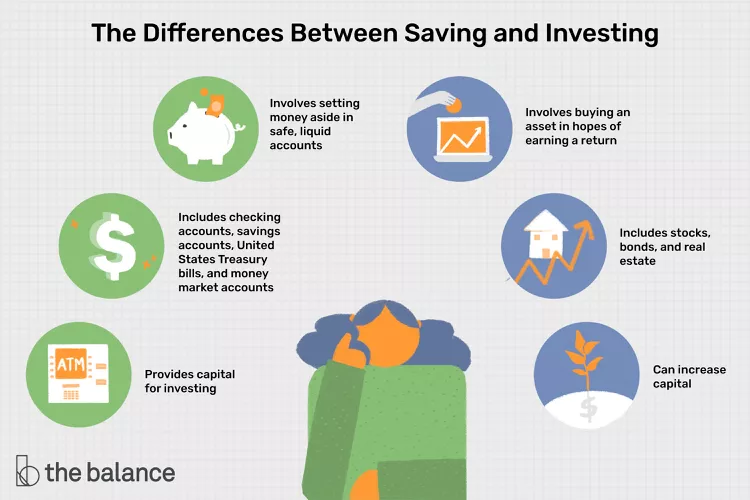

Saving money and investing money are entirely different things, with different purposes and different roles in your financial strategy. Saving money involves setting funds aside in safe, liquid accounts. Investing involves buying an asset like stocks in hopes of earning a return. Make sure you are clear on this fundamental concept before you begin your journey to building wealth and finding financial independence.

Even with a great portfolio, you still risk losing everything if you don’t appreciate the role of savings. Learn how to find the right balance between saving money and investing money.

What’s the Difference Between Saving and Investing?

| SAVING | INVESTING |

|---|---|

| Setting money aside in safe, liquid accounts | Buying an asset that you anticipate will give you a good rate of return |

| Includes checking accounts, savings accounts, and money market accounts | Includes stocks, bonds, and real estate |

Saving money is the process of setting cash aside and parking it in extremely safe securities or accounts. The money is also liquid, meaning cash can be accessed in a very short amount of time. These types of accounts can include:

- Checking accounts

- Savings accounts

- United States Treasury bills

- Money market accounts

Above all, cash reserves must be there when you reach for them. They must be available to use immediately with minimal delay, no matter what is happening around you. Many famous wealthy investors advocate keeping a lot of cash on hand, even if it involves a major loss since those funds aren’t being invested or earning a higher rate of return.

Important

Only after capital preservation is accounted for should you worry about secondary considerations for the money you have parked in savings, such as keeping pace with inflation.

Investing money is the process of using your money, or capital, to buy an asset that you think has a good probability of generating a safe and acceptable rate of return over time. The goal of investing is to make you wealthier, even if it means suffering volatility, perhaps even for years.

True investments are backed by some margin of safety, often in the form of assets or owner earnings. The best investments tend to be “productive assets,” such as stocks, bonds, and real estate.

How Much Should You Be Saving vs. Investing?

Saving money should almost always come before investing money. Think of it as the foundation upon which your financial house is built. The reason is simple: Unless you inherit a large amount of wealth, it is your savings that will provide you with the capital to feed your investments.

If times get tough and you require cash, you’ll likely be selling your investments at the worst possible time. That is not a recipe for getting rich.

As a general rule, your savings should be sufficient to cover all of your personal expenses, including your mortgage, loan payments, insurance costs, utility bills, food, and clothing expenses for at least three to six months.2 That way, if you lose your job, you’ll have sufficient time to adjust your life without the extreme pressure that comes from living paycheck to paycheck.

Important

Any specific purpose in your life that will require a large amount of cash in five years or less should be savings-driven, not investment-driven, as the stock market in the short run can be extremely volatile.

You should begin investing only after these things are in place (and you have health insurance). The only possible exception is putting money into a 401(k) plan at work if your company matches your contributions. Not only will you get a substantial tax break for putting money into your retirement account, but the matching funds basically represent free cash that is being handed to you.

The Bottom Line

It may seem daunting now, but every successful self-made person had to begin by earning money, spending less than they earned, saving money, and then taking excess savings and putting it to work.

By learning tips to help you manage your money with discipline, you can enjoy some of the same rewards of success.

Frequently Asked Questions (FAQs)

How do you invest money?

You have many options for investing money. If you have an employer that offers a 401(k), that’s a good place to start investing for retirement. If you’re saving for retirement on your own, brokerages can help you open a traditional or Roth IRA.

If you’re looking to invest outside of retirement accounts, start by finding a brokerage. If you’d like assistance, you can work with an advisor. Many also have robo-advisors that can help you find stocks, bonds, mutual funds, and ETFs that fit your interests and investing goals. Look for a brokerage that offers the level of assistance you need along with reasonable fees.

How do you start saving money?

The best way to build savings is by putting money away consistently, even if it’s small amounts. Set up small automated deposits daily or weekly. Some apps allow you to round up purchases and put the difference in your savings account. To build up your savings more, develop a budget and ensure your expenses are less than your income. Set a savings goal and ensure you put money in savings first before paying any other bills. In other words, pay yourself first.