How Bitcoin Is Taxed

The IRS treats bitcoin and other “convertible virtual currencies” as property, more specifically a capital asset, rather than a currency. That means there are tax consequences whenever bitcoin is bought, sold, or traded. This might sound like a minor distinction, but it’s not. It determines how bitcoin is taxed—similar to how owning and trading stocks or exchange-traded funds (ETFs) can trigger capital gains taxes.

With that said, it’s important to have the information you need to make sure your taxes are calculated correctly. You’ll also want to consider tax-planning techniques you can use to try to minimize the taxes you pay on bitcoin.

Key Takeaways

- The IRS treats Bitcoin like a capital asset, which means you may have to pay capital gains taxes on bitcoin transactions, whether selling it or making purchases.

- For most individuals, the long-term capital gains tax rate for bitcoin held for at least a year is between 0% and 20%.

- Some individuals may be subject to a net investment tax if they sell their bitcoin or use it as payment for goods and services.

The IRS and Cryptocurrency

The IRS treats cryptocurrency

DEFINITION

Cryptocurrency is digital, or virtual, electronic money.More >—like bitcoin—as a capital asset. It has indicated that virtual currency doesn’t have status as legal tender in any jurisdiction. It’s referred to as “convertible” virtual currency if it has an equivalent value in real currency, or if it ever serves in place of real currency. It can be exchanged into another currency, either real or virtual, and it can be digitally traded.

When Do You Have To Pay Taxes on Bitcoin?

Because the IRS treats bitcoin as a capital asset, it is subject to general tax principles.

If you invest in bitcoin and then sell or trade it for a higher price than you bought it for, you owe capital gains taxes. If you own bitcoin and use it to make a purchase, that is also considered selling it, so you will have to pay capital gains taxes if the bitcoin you own is worth more than what you paid for it when you bought it.

If you’re paid in bitcoin for goods or services, you must include the fair market value of the bitcoin you in U.S. dollars in your gross income. Transactions using virtual currency should be reported in U.S. dollars, too.

As with other types of assets, you would acquire them first, often by exchanging cash for the assets. You then own them for a period of time, and you might eventually sell those assets, give them away, trade them, or otherwise dispose of them. Capital gains taxes come due at this point.

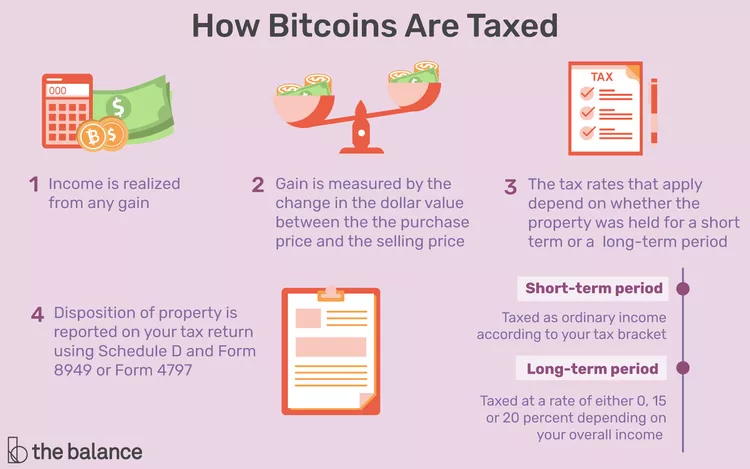

Four things may happen if you sell, trade, or no longer own your bitcoin:

- Income is realized from any gain.

- Gain is measured by the change in the dollar value between the cost basis or purchase price and the gross proceeds received from the disposition or the selling price.

- The tax rate that applies depends on whether the property was held for one year or less (a short-term gain) or for more than a year (a long-term gain).

- Disposition of property is reported on your tax return using Schedule D and Form 8949 or Form 4797. These forms require that you show your math when you’re calculating a gain or loss. You’ll do your calculations right on the form, per instructions.

Reporting Cryptocurrency on Tax Returns

Cryptocurrency transactions must be reported on your individual tax return or IRS Form 1040. If you engage in any transaction involving cryptocurrency, you must check the appropriate box next to the question on virtual currency, even if you received any for free, including from an air-drop or hard fork. Do not check this box if you only engaged in transactions among wallets that you yourself own.

How Capital Gains Taxes Work on Bitcoin

Suppose you purchased one bitcoin for $30,000. You then sell it for $50,000, so you have a $20,000 capital gain. This would be a short-term gain if you held the bitcoin for one year or less, and it would be taxed as ordinary income according to your tax bracket. It’s a long-term gain taxed at a rate of either 0%, 15%, 20%, depending on your overall income, if you owned the Bitcoin for longer than one year.

Note

All of your gains would be short-term, and you would report them on Form 4797 if you elect market-to-market trading. Any bitcoin-related expenses would be deductible on Schedule C.

The Net Investment Income Tax

You might also find that you’re subject to the net investment income tax that applies to investment income. The tax is due if you’re a single taxpayer, and your overall modified adjusted gross income (MAGI) from all sources is more than $200,000 for the year. The threshold increases to $250,000 for married taxpayers who file jointly and qualifying widow(er)s. It drops to just $125,000 for married taxpayers who file separate returns.

How To Pay Taxes on Bitcoin

Establish a record-keeping system for all your transactions, and keep track of when you acquire and when you dispose of bitcoin. Identify your cost basis method and your exchange rate. Then record the dispositions of bitcoin on Schedule D and Form 8949.

Note

Keeping detailed records of transactions in cryptocurrency ensures that income is measured accurately.

Normal capital gains strategies apply: You can offset gains with losses, time your dispositions to qualify for long-term treatment, harvest your losses, and harvest your gains. A tax professional can help you with these concepts. The income is reportable on your personal tax return, normally due April 15 of each year (or a subsequent working day if April 15th falls on a holiday) unless you request a six-month extension from the IRS.

What Happens If You Don’t Pay Taxes on Bitcoin?

Bitcoin is no different from other sources of taxable income or assets. If you shrug your shoulders at the IRS and don’t pay taxes on bitcoin transactions, even if you didn’t know you were supposed to do so, you’ll be penalized. You’ll be charged interest at the rate of 0.5% of the amount of tax you owe, up to a cap of 25% of the unpaid balance.

The IRS additionally has numerous enforcement options for collection, from liens against your property to levies on your income and bank accounts.

Tax Tools for Bitcoin

Casual bitcoin users might want to consider using a reputable bitcoin wallet provider that has implemented risk-mitigation tools to make buying, trading, and selling bitcoin more secure and user-friendly. Even aside from tax considerations, investors should take a look at wallet providers or registered investment vehicles with the kind of security features that one might expect from a banking institution. These tools might come in handy both when you’re handling transactions and when you’re planning for taxes.

BitcoinTaxes, the web-based software for importing data and calculating gains/losses, may be helpful as well.

Frequently Asked Questions (FAQs)

How do you avoid or minimize taxes on bitcoin?

The methods for minimizing your tax burden with cryptocurrency are similar to how stock traders minimize their taxes. Holding your positions long enough to qualify for long-term capital gains is the easiest way to reduce your tax burden. You may also find a retirement account that allows for cryptocurrency investments, and these tax-advantaged retirement accounts can reduce or eliminate your tax burden on gains.

How do you handle cryptocurrency taxes when filing taxes with TurboTax?

TurboTax recommends using the Premier tax filing package when you need to account for bitcoin transactions or any other type of cryptocurrency trading. Coinbase customers can import transactions directly into TurboTax Premium.

Can you deduct bitcoin losses?

Bitcoin losses are treated similarly to stock losses. You can deduct the bitcoin losses to reduce your taxable gains. If you had a net loss, then you can deduct up to $3,000 of that loss from your ordinary income.