How to Evaluate the Cost of Hiring a Financial Advisor

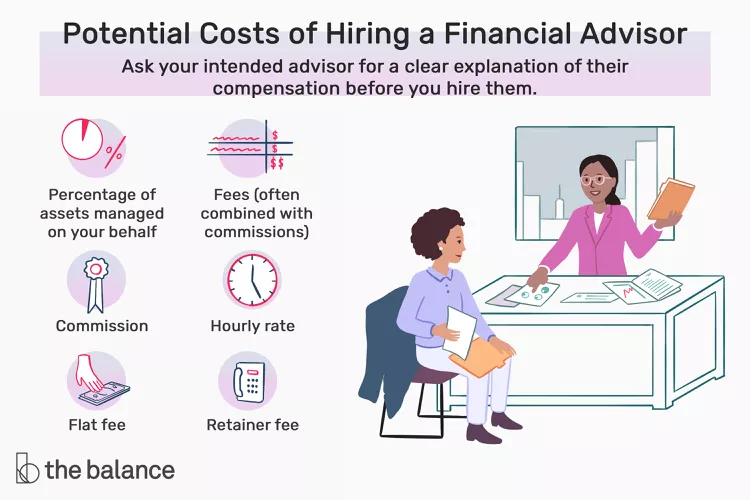

Estimating the costs of an investment advisor can feel as daunting as doing financial planning. Some financial advisors charge fixed fees, and others deal in variable percentages. There are six ways financial advisors charge their fees. Learn what they are, so you can find the right professional. This information can also help you budget for important advice to help you meet your financial goals.

Key Takeaways

- Some financial advisors may charge fees based on a percentage of your assets, others may charge a commission on the financial products they sell you, or it could be a combination of both.

- Advisors may charge flat fees or rates that aren’t tied to how much money you have or which products you buy.

- Some fee structures may incentivize an advisor to make certain recommendations to increase the money that they make or that you make.

- It’s important to ask your financial advisor about their fees and charges. That can help you decide whether their fee structure works for you.

Percentage of Assets

One of the most common ways that financial or investment advisors will charge you is by basing it on a percentage of the assets they manage on your behalf. Average fees can range from 0.50% to 2.0% per year. In most cases, the more assets you have, the lower the percentage of your total assets they will charge.

Many investors like this structure. The fees are taken right from accounts. No check has to be written, and the fees don’t have to come out of your monthly budget. Fees debited from tax-deferred accounts, such as IRAs, are paid with pre-tax dollars. This can slightly reduce your account balance and taxes upon withdrawal. That makes them highly beneficial for those in retirement.

When you hire an advisor who is paid that way, find out what types of services they provide: investment management, financial planning, or both. Expect to pay a higher fee if the advisor provides full-service financial planning along with investment management.

You also want to ask whether the advisor is fee-only or fee-based. Fee-only advisors only charge a fee based on your assets. They don’t earn additional commissions based on product sales. They have a fiduciary responsibility to act in your best interests. They are more likely to use low-cost funds in your account that reduce your overall cost.

In contrast, fee-based advisors may be able to collect commissions on top of the fees charged on assets.

Tip

The National Association of Personal Financial Advisors (NAPFA) has trademarked its “fee-only” logo. Member advisors must submit documentation and take an oath that they do not sell any investment or insurance products. NAPFA can be a great resource for finding a “fee-only” advisor.

With an asset management percentage fee, an advisor makes more money as your account value increases. If your account value decreases, they will make less money. That is why your advisor will have an incentive to grow your account and minimize your losses.

Some advisors have come up with variations on this payment option, which could include charging a percentage of net worth, with the goal of helping you increase your worth. Or they could charge a percentage of your adjusted gross income, with the goal of giving career counseling to help you boost your income.

Commissions

Some financial advisors charge a flat rate or a percentage of the purchase or sale of an investment you make through them. These costs are also known as “commissions” and can range anywhere from 3% to 8.5% of the investment price. Commissions most often take two forms:

- A front-end load: An advisor who uses this pricing structure will charge you upon the purchase of an investment. You would give the investor an amount to invest, and a flat fee or a percentage of that amount would be withheld.

- A back-end load: You wouldn’t be charged when you buy the investment. Still, a flat fee or a percentage of your investment would be deducted when you stop holding the investment.

Commissions may also be paid directly to the advisor from the investment company, as in the case of the sale of many non-publicly traded real estate investment trusts (REITs). Ask for a clear explanation of how much the financial advisor will cost and from whom they will receive the fee if you buy the investments they recommend.

That option may seem enticing. The cost doesn’t come out of your pocket, and the advisor’s commission is not tied to your total assets. Still, some advisors who charge via commissions may be compensated for product sales. That might motivate them to recommend that you buy a costly investment that isn’t right for you, so always look closely at the advisor’s involvement. Figure out whether they are an honest broker or simply a good salesperson looking to close a deal.

Combination of Fees and Commissions

Many advisors today collect both fees and commissions. These advisors are described as “fee-based.” They may, for instance, charge a small percentage based on the assets they manage. They may also charge a flat rate or a percentage in commissions when you buy or sell an investment.

The benefit of this pricing structure is that it is not tied exclusively to your asset value or to your investment-purchase decisions. That way, advisors won’t be motivated only by product sales; a portion of what they earn is based on your assets.

Still, be sure to ask how much the advisor’s services will cost in fees vs. commissions. As with those who charge by using a commission-only model, do your research. You want to choose an advisor you can trust.

Hourly Rate

Advisors who charge according to this fee model will bill you a certain amount for each hour of advice they provide. The costs can add up if you need an advisor who will hold your hand throughout the process. But paying by the hour can be a great choice if you are willing to implement their advice on your own. For instance, you might pay a financial advisor an hourly rate to tell you how to allocate the investments in your 401(k) plan. You can then make the changes they suggested on your own, which can help you avoid additional costs.

Just like attorneys or accountants, hourly rates will vary widely from advisor to advisor. They are often anywhere from $150 to $400. Expect to pay a higher hourly rate for experienced advisors or specialty advisors. Lower rates will be charged by less-experienced advisors.

Since an hourly rate is not tied to the value of investments or to the purchase of any specific investment, you can feel confident that you will receive objective advice. You will pay out of your own pocket. Keep your costs low by limiting the help you request from them. Be sure to go to planning sessions with your questions already prepared.

Note

To find an advisor who charges an hourly rate, check out the Garrett Planning Network, which offers a search service to connect you with a national network of advisors who offer advice at hourly rates.

Flat Fee

When you need help with a financial planning project, working with a financial advisor for a one-time cost is useful. For instance, when creating an initial retirement plan, it may make sense to pay a flat fee for them to crunch the numbers. That can help you understand what goes into making a strong retirement plan projection.

The specific costs vary by project. The cost for an advisor to put together a retirement plan might be anywhere from $700 to $3,500, for instance. Keep in mind that you will pay out of your own pocket, but the great thing about this fee model is that it makes it easy to budget for getting financial help. The flat fee is not tied to the value of your investments or to the purchase of any specific investment.

To aid in budgeting, ask to be told the fee upfront, and get a clear description of what will be covered by that fee. Ask whether follow-up meetings or questions are included in the fee. If so, ask how many.

Note

Another flat-fee type of model, XY Planning Network, offers a subscription fee plan. More and more advisors are breaking down annual financial planning fees into monthly subscription costs. This may be easier on your wallet.

Retainer Fee

According to this pricing structure, you would be charged a flat fee at regular intervals, such as quarterly or annually, to retain the ongoing services of an advisor. You may benefit from ongoing help if you have a more complex situation, such as ongoing stock options to be exercised, a small business, rental properties, or the need to draw a regular income from your investments.

The specific fee depends on the scope of services provided. It also depends on the experience level of the advisor. While thorough financial planning can range from $2,000 to $10,000 per year, planning and investment management can push you into the annual range of $5,000 to $30,000.

For prices like those, you can most often be assured that your advisor will not advise against your best interests because a retainer fee is not tied to the value of investments or the sale of specific products, but you will have to pay them directly.

After visiting one of these financial advisors and sharing the complexity of your situation, ask some questions: What your retainer fee would be, the intervals at which you would pay it, and the services included in that fee. A written contract detailing the fee and services is usually provided.

How to Find Out Your Advisor’s Fees

Fees can vary under each of these compensation structures. The best way to estimate a financial advisor’s costs is to ask for a clear explanation of their compensation before you hire them.

Look for an honest, straightforward answer. Steer clear of those who try to avoid the question, tell you not to worry, or imply that services are free. Online advisor search engines allow you to search by specific criteria, such as what compensation structure an advisor uses.