This is the No. 1 reason Americans are withdrawing from their savings

Among record-high credit card debt and reports of many consumers living paycheck to paycheck, Americans are relying on their savings to cover monthly bills and common everyday expenses, including groceries.

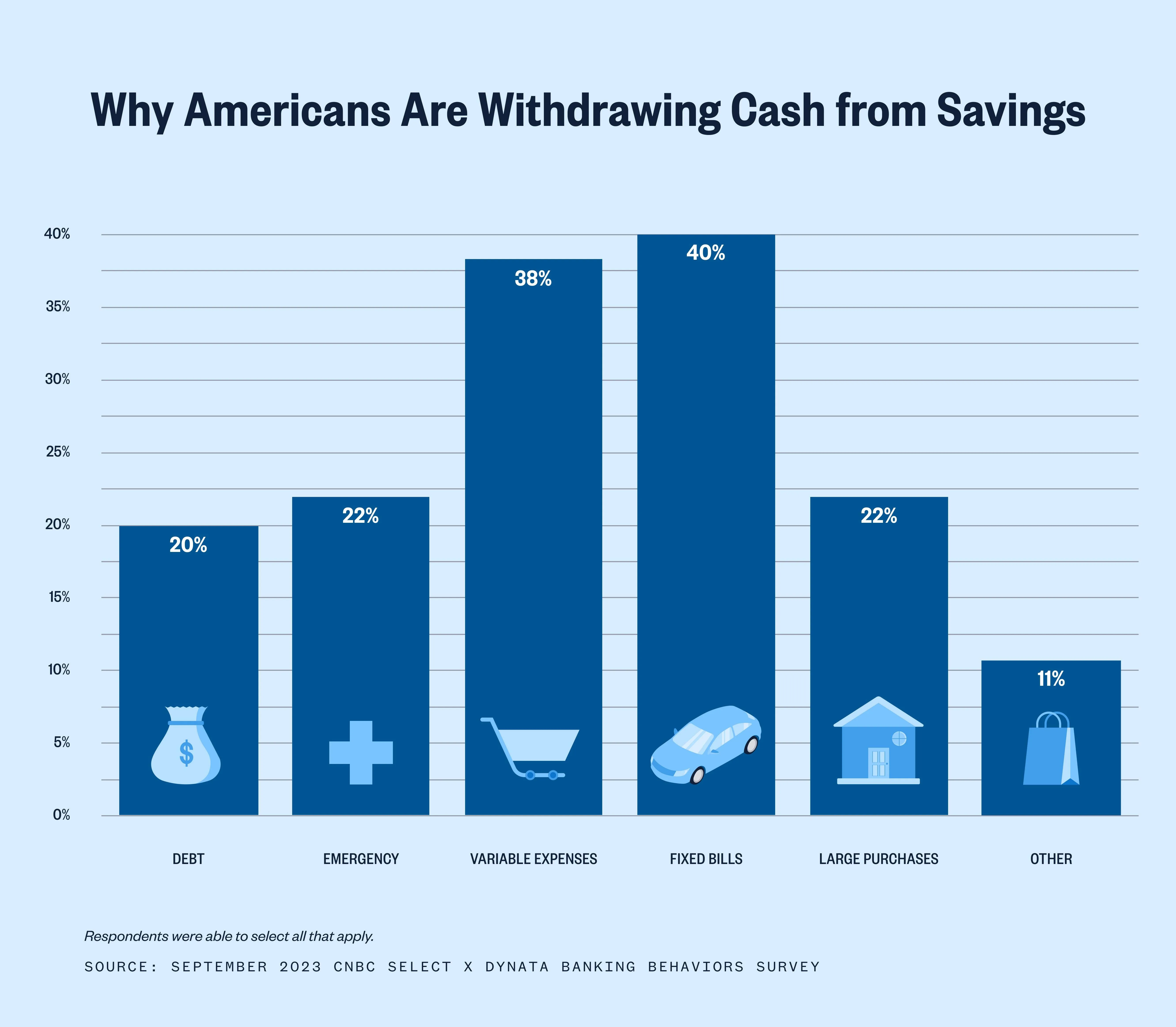

A recent CNBC Select and Dynata Banking Behaviors Survey found that 40% of respondents who reported having withdrawn cash from their savings say they did so to cover fixed bills, such as a car payment. The second most cited reason, at 38%, was to cover variable expenses like groceries.

While the broader economy has been looking better in recent months — with cooling inflation, a still strong job market and the stock market near all-time highs — consumers are still strained. Many households haven’t made it through the inflation fight unscathed, explains Kathryn Anne Edwards, an economist and economic policy consultant.

“Economic indicators say we’re doing better [than a year ago], but households don’t think of prices in 12-month growth rates,” Edwards says. With years of accumulated price increases, it’s no surprise that Americans are dipping into their savings to cover everyday expenses.

The top two reasons Americans tapped into their savings were to cover expected monthly costs, including car payments and groceries.

September 2023 CNBC Select x Dynata Banking Behaviors Survey

Compare offers to find the best savings account

22% of Americans tapped into their piggy banks for a large purchase like a house, according to the survey, and the same number reported that they had to use their savings to cover emergencies, like a hospital visit.

While it’s smart to avoid debt to cover necessities, especially with record inflation in recent years, making a habit of using savings can run it dry fast.

“If you’re dipping into savings to make ends meet, you’re ahead of those who are borrowing from creditors or their own retirement funds to get by,” says Sarah Newcomb, of THRIVE Financial Empowerment Center and a former behavioral economist for Morningstar. “Still, inflation is a long-term reality, and you should focus on finding ways to cut costs, earn more and possibly restructure debt so that you can get back on track and replenish those emergency funds.”

Ways to avoid tapping into your savings

1. Use a checking account for recurring expenses

It’s best to keep money for regular expenses like car payments and groceries in a checking account, which allows for unlimited access to your cash. Savings accounts can impose monthly withdrawal limits.

Certain online checking accounts offer a solid return on the money sitting in your account, too, with APYs that are competitive to what high-yield savings accounts offer.

2. Create a ‘budget buffer’

When thinking about budgeting, make sure your checking account has enough in it to cover your monthly needs, plus a small “budget buffer,” as Newcomb calls it.

“We typically don’t build enough slack into our budgets to cover the ordinary-but-irregular expenses that always come up,” Newcomb says, like annual car registration, haircuts or occasional gifts.

You can start by looking at your actual spending from the last three months to get an idea of how much slack you should build into your budget to make ends meet. “In my own household, I’ve learned to add about 10%,” Newcomb says.

The idea is that this budget buffer in your checking account will help with expenses that pop up so you don’t need to turn to your savings.

How to maximize your savings

The national average APY on a regular savings account is just 0.46%, while many high-yield savings accounts have interest rates over 5%. Yet, 57% of Americans are using a traditional or regular savings account, according to the CNBC Select Banking Behaviors Survey.

Survey methodology

The CNBC Select Banking Behaviors Survey of 1,151 Americans across the country was conducted online from Sept. 8, 2023 to Sept. 19, 2023 by Dynata. Survey respondents were nationally representative by gender, age, race and ethnicity using 2020 Census data. Women represented 50% while men represented 49% of respondents and spanned a wide variety of incomes. All those surveyed were 18 or older. The margin of error for the survey was +/-3%.

Why trust CNBC Select?

At CNBC Select, our mission is to provide our readers with high-quality service journalism and comprehensive consumer advice so they can make informed decisions with their money. Every banking article is based on rigorous reporting by our team of expert writers and editors with extensive knowledge of banking products. While CNBC Select earns a commission from affiliate partners on many offers and links, we create all our content without input from our commercial team or any outside third parties, and we pride ourselves on our journalistic standards and ethics.