What Is the Fear and Greed Index?

An initial draft of this article was created by NerdWallet using automation technology, then thoroughly reviewed, edited and fact-checked by NerdWallet’s human writers and editors.

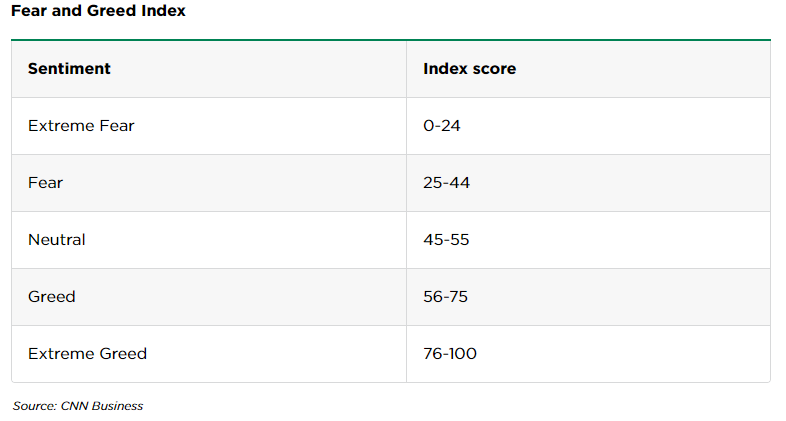

The Fear and Greed Index (developed by CNN Business) is a measure of investor sentiment, which ranges from extreme fear to extreme greed. The thinking is that “excessive fear” leads to lower stock prices, and “too much greed” leads to higher stock prices, according to the index. Thus, it can help investors determine whether stocks are priced fairly.

How does the Fear and Greed Index work?

The index — a score from 0 to 100 — is calculated by analyzing seven different indicators that measure market volatility, investor sentiment and other factors that impact the stock market.

The seven indicators are:

- Market Momentum: This measures the performance of the S&P 500 index against the moving average over the past 125 days. If the S&P 500 index is rising, it indicates that investors are optimistic about the economy and the stock market.

- Stock Price Strength: This measures the number of stocks on the New York Stock Exchange (NYSE) that are trading at their 52-week highs, compared to the number of stocks trading at their 52-week lows. More highs than lows indicates that the market is strong and investors are optimistic.

- Stock Price Breadth: This measures the number of stocks that are rising versus falling. If more stocks are rising, it indicates that investors are bullish.

- Put and Call Options: This measures the ratio of put options (which are like a contract that gives the owner the option to sell an underlying asset) to call options (which gives the owner the option to buy an underlying security). If more investors are buying put options, it indicates that they are trying to protect their investments against a potential downturn in the market.

- Junk Bond Demand: This measures the difference in yields between high-risk, high-yield junk bonds and safer government bonds. Increasing demand for high-yield bonds indicates that investors are willing to take on more risk, which the index factors as a sign of “greed.”

- Market Volatility: This references the Cboe Volatility Index (VIX), a predictive measure of expected changes in the S&P 500 Index options over the next 30 days. Over time, a low VIX index indicates a bull market and high index indicates a bear market.

- Safe Haven Demand: This measures the demand for Treasury bonds compared to riskier stocks. If the demand for bonds is higher, it indicates that investors are fearful and are seeking safe havens to protect their investments.

How is the Fear and Greed Index used?

The Fear and Greed Index is used by investors to gauge the overall sentiment of the market and to help make informed decisions about buying or selling stocks.

Each indicator is given equal weight in determining an index between 0 and 100. When the index is high — showing greed or extreme greed — it indicates that investors are optimistic and are buying stocks. When the index is low — showing fear or extreme fear — it indicates that investors are fearful and are selling stocks.

For example, in March 2020 at the beginning of the COVID-19 pandemic, the Fear and Greed Index dropped to an annual low of 2. This was due to the uncertainty and fear surrounding the pandemic, including a travel ban. Investors moved to sell their stocks and seek safe havens, and the stock market experienced a significant decline.

Limitations of the Fear and Greed Index

While the Fear and Greed Index can be a useful tool for investors, it is not a perfect indicator of market sentiment. The index is based on a limited number of indicators and doesn’t predict other factors that can impact the stock market, such as geopolitical events and economic data.

The Fear and Greed Index is also not the only tool that investors use to assess the market’s mood.